Right now, there is a lot of speculation that Chinese yuan or renminbi will replace the US dollar as the most dominant global currency for central banks globally. There are some seriously strong reasons for that argument and they do hold merit. Let’s see how the Chinese currency competes with US dollar.

Central bank power

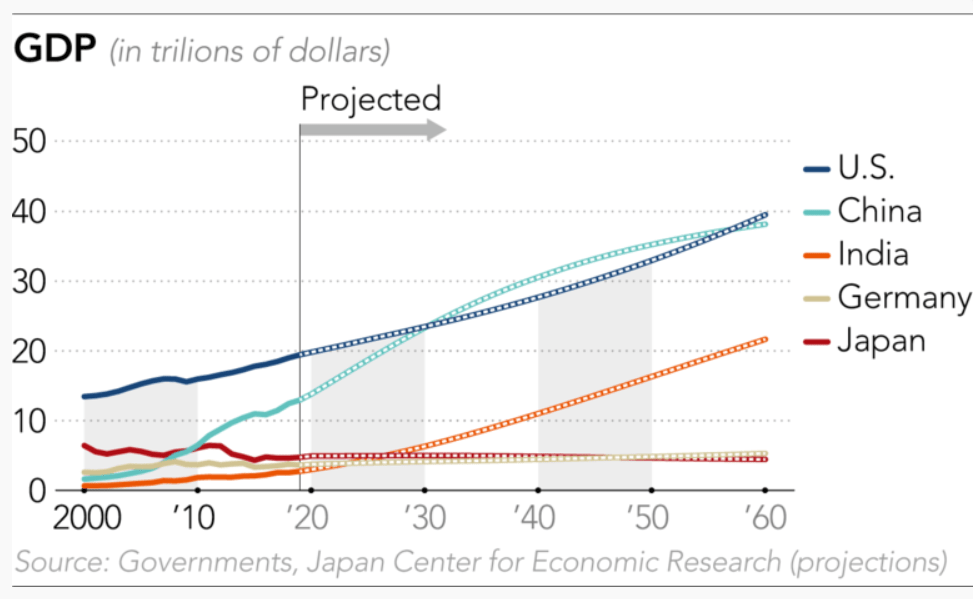

We all know China is the world’s largest producer of goods and services and is on track to become the world’s largest economy. US on the other hand is witnessing a fall in its economic growth rate. However, worldwide financial market transactions are carried out in US dollar. The reason for this is three fold- stability, predictability and transparency. To truly understand what I mean by globally dominant currency we need to understand the power and influence of dollar. Today, US is in a position where it doesn’t have to maintain forex reserves(it stood at 129 billion dollars vs China’s 3.1 trillion dollars as per 2020). The reason for this is that, the US is the largest consumer market today. Another reason is that whenever any crisis takes place in US or other country which can impact economic growth the first and foremost reaction which you will normally notice is that investors run towards US government securities or better known as US treasuries. If you know anything about finance theory on interest rates globally the most safest instrument happens to be the US treasury securities and it acts a base over which all rates are decided based on credit risk, liquidity risk or any other risk. This is entirely perception but this perception is again backed by the three factors I mentioned. Also, the dollar helps US achieve its economic and political goals globally. The economic clout of the US forces businesses, central banks and investors globally to follow what US says or does and it’s evident when US places sanctions on different regimes.

China is now making efforts to make its currency the globally dominant currency. In 2015, IMF added Chinese yuan to its list of elite currencies which are part of central bank reserves which includes the US dollar, Euro, Japanese yen and the British pound. To be globally dominant the country should have economic clout , dominate politically and have trust of investors. Let’s see what component of central banks reserves does US dollar and Chinese yuan make up since this metric is highly influential in determining which currency is perceived to be strong. At the end of 2020, Chinese yuan made up 2.25% of forex exchange reserves of central banks globally. Meanwhile, US dollar made up 59% of central bank reserves(lowest in 25 years). It had a share of 71% in 1990 when euro was launched.

China’s economic power

I think its safe to say China is economically powerful and has the potential to beat US in coming years as its size expands further. We need to look at both positives and negatives. The positive is the manufacturing capability, the infrastructure and technological progress China is making. Due to the manufacturing capability, Chinese goods are demanded world over which means the currency will remain in high demand and with growing economic size, consumption will cause foreign investments to only increase going forward and increase in trade. There are three major negatives of China which should make investors jittery. One is technology, China needs access to American and European semiconductor technology to keep its tech products competitive enough in global marketplace. Chinese companies are losing access to important technologies in this area( Huawei case in point, US sanctions decimated the smartphone business of Huawei completely). Chinese efforts to develop semiconductor technologies has failed miserably. Second, the debt funding which has taken place to support years of growth in Chinese infrastructure post financial crisis of 2008. Nobody truly knows the extent of debt Chinese regional governments have taken. There is a high chance of hidden debt due to lack of transparency. The most important thing, China is now making a switch to shift its economy from investment driven to consumer driven. The challenge here is Chinese savings rate are highest in the world with 45% income saved. Household ownership costs are running very high (many Chinese now own two homes but with no one to rent to and stock market penetration is low at 6% vs US where it is 55% and real estate still remains the main vehicle for wealth creation) , Chinese have a culture where young people need to have a house for being eligible to marry and real estate prices have become unaffordable in major cities with a major bubble waiting to burst unless incomes rise significantly to justify the real estate prices. Chinese home ownership rate is already at 90%. All in all, the trend still supports China economically.

Political domination

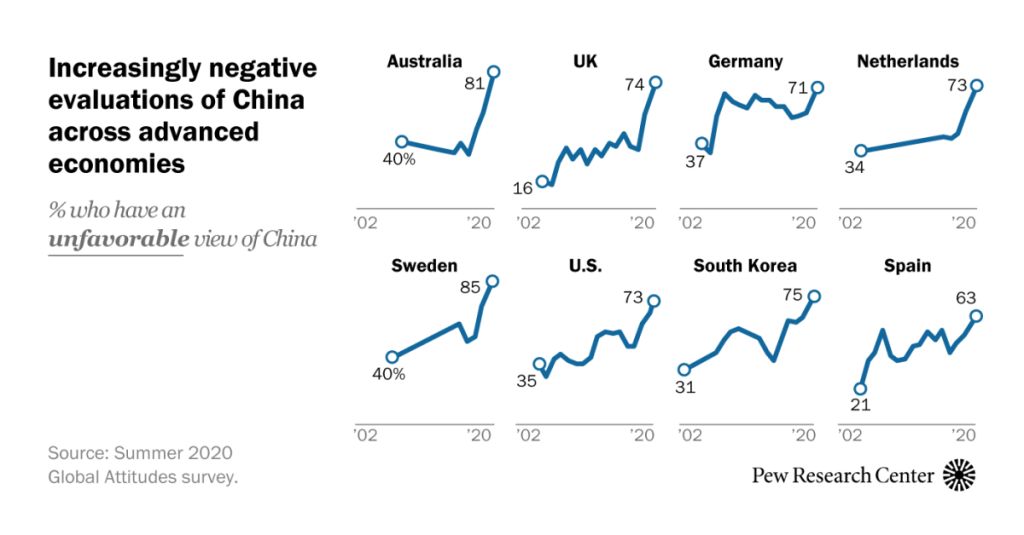

Politically, China is losing its power as the world has turned its perception to extremely negative against Chinese. With trade wars and sanctions being fired from both sides, the situation has only deteriorated from 2018 and Covid-19 gave it the one last final blow to damage it completely. China’s debt trap diplomacy has lead to cancellation of several multi billion dollar projects globally as well. Even China is now becoming more inward with its policies and wolf war diplomacy. Vietnam, an authoritarian country is skeptical of China and is increasing its ties with US. These trends don’t support the ambitions of a currency which is supposed to go global. US had outstanding political clout when US dollar was made the globally dominant currency. Also, to block the rise of China, West and China skeptics can stop purchasing yuan denominated assets for foreign exchange reserves. There is no authoritarian country in the world large enough to support Chinese cause.

Trust of investors

This is ultimately the most important thing. What kind of trusts investors have on China and its economy? Three things matter here- stability, predictability and transparency. Stability wise I think China deserves the credit as Chinese economy has been stable and its moving towards becoming the developed country status. Plus, the peg on Chinese currency exchange rate with US dollar makes it less risky, however, yuan needs to be freely floating to deserve the globally dominant status. Chinese exports are competitive today because of the currency peg. Once it becomes a free floating currency there is high expectation of export power erosion in China. US dollar has been freely floating and has managed to hold its own and its because of stability and trust investors have on US economy. The biggest test will be when yuan will be able to freely float without state intervention. There is opinion among market players of significant undervaluation of Chinese yuan. Chinese economy predictability wise has taken a hit although not a bad one since the regulatory crackdown on education and tech sectors which spread the rout to other sectors as well. This is more temporary in nature but assumes significance since China is altering the social structure and population goals with this crackdown and begs the question will China undo some reforms associated with market economy to achieve socialist goals. Transparency is a big question mark in my opinion as the Chinese housing bubble has not been allowed to burst which puts a big question mark on future wealth of Chinese consumers which is highly concentrated in real estate. Consumers can only spend money if they feel safe about their net worth and incomes and if there is a major artificial intervention stopping a bubble from bursting the problem will only grow. Chinese home ownership rate is at 90% and Chinese population is still going after real estate investments (evident in appreciating prices and general trends visible in Chinese economy) above stocks ( stock market is highly volatile) and other financial instruments.

Conclusion

If China maintains its trajectory of economic growth and keeps reforming its currency controls there is a high chance Chinese yuan could end up becoming globally dominant. Investors need to remember Chinese middle class will fuel the consumption market of China which will be much much larger than the US consumption market. China may stay inward but it will surely will become the world’s largest consumption market going forward if Chinese government successfully manages its economic and political risks.

Leave a reply to Prasad Dhonde Cancel reply