What a week ! Finance minister Nirmala Sitharaman undertook a very bold reform to boost the economy and also provide a long term structural change which will change the trajectory and put it on high gear for the overall economy. Finally, Indian corporates got their duly deserved tax break that they have been wishing for. India lowered the corporate taxes rate (22% without exemptions)in a blockbuster move on Friday. It definitely went a long way to appease the investors.The market zoomed up by more than 5%, single biggest gains in a day in years! What was more extraordinary about the announcement is the focus on manufacturing sector. India lowered the tax rate on manufacturing units to 15% for units incorporated on or after October 1st, 2019 and initiating operations before 31st March, 2023. So why is all of this important?

1.First of all, FDI

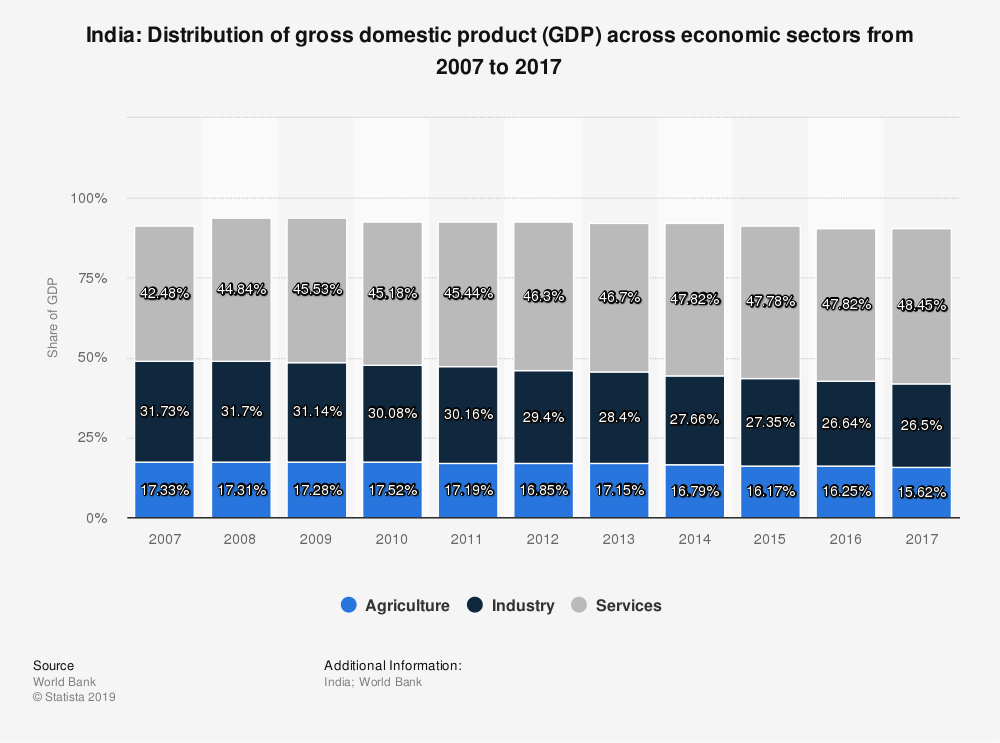

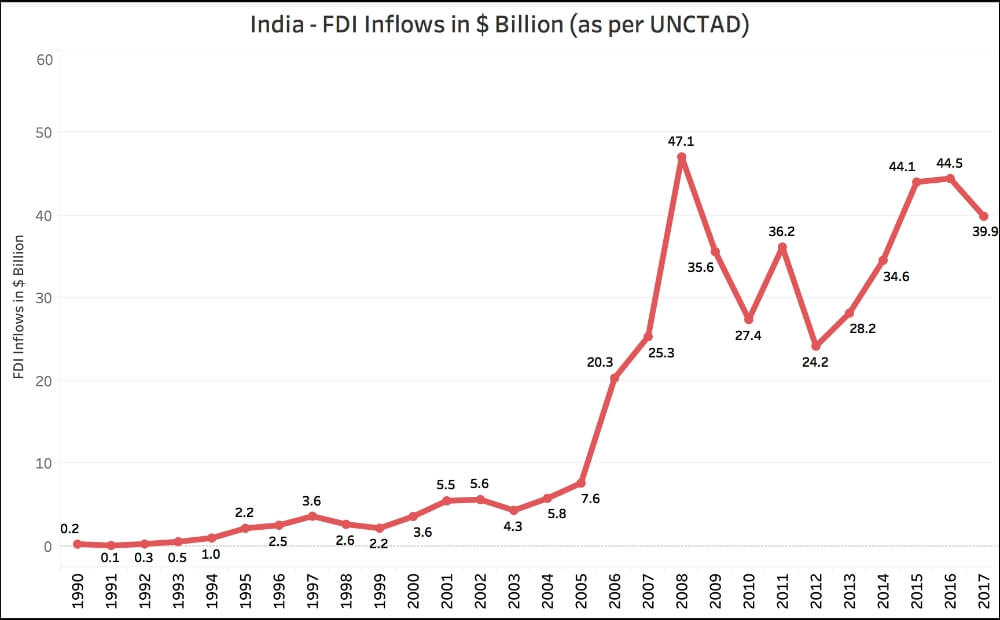

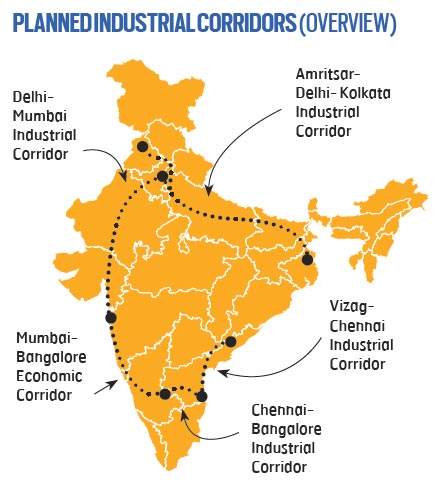

This goes without saying that India is truly inviting global companies to come and set up shop in the country. Reaching the goal of manufacturing contribution of 25% in GDP in 2025 seems realistic now. This part is really important to address the job problem. Foreign direct investment is a very crucial component for any country. It is a testament to the country’s superiority in economic front. China witnessed astounding growth rates due to FDI. They received so much capital which help kick up start an economic revolution. Now China is under the focus of a President who doesn’t care about anything but America. Beijing may find it tough to crack a deal without comprising on some crucial aspects. The scenario has sweetened up for India. Although, trade war was waging, India wasn’t benefitting. Companies went to its neighbours and other countries globally. This can change now. With India willing to offer concession in taxes and preparing a mega infrastructural push, this opportunity is big. It is big because groundwork is being laid for a mega transformation which could put India on map for global supply chains. A 100 lakh crore rupees infrastructural investment in next 5 years, coupled with low manufacturing corporate tax of 15%, effectively 17%, presents an opportunity to diversify supply chains. Government didn’t have to sacrifice on revenue fronts as well because this tax rate is valid for future manufacturing companies.

2. Deficit increase?Not to worry

There is a lot of concern surrounding the deficit that the tax cut will create. 1.45 lakh crore rupees of revenue will be forgone in undertaking these tax cuts. This can increase fiscal deficit to 4% of GDP. Increase in fiscal deficit will fuel inflation and increase government obligations. All of that is true but at the same time, you get an increase in savings by 1.45 lakh crore. These savings will transmit in the form of capital investment, price cuts and increase in other activities. This will fuel the economy. There will be lag ,of course. There couldn’t have been a better time to undertake these reforms. Interest rates are falling globally, investment and spending is falling and other slowdown signs are visible. It will be a great chance to further open up financial markets as India needs a lot of capital now. FDI alone won’t fulfil the demand. Current crowding out of funds can only be addressed by integrating India more with global financial markets. Another concern is the infrastructure spending which the government plans to undertake. Total outlay is 100 lakh crore for 5 years which works out to 20 lakh crore per year. So based on current estimates India will have to spend 10.5% of GDP on infrastructure alone which shall start falling year by year as GDP size increases. Government will have to make it easier for private players, including foreign entities, to help build infrastructure in India. That will require lot of capital and India alone can’t provide that amount of capital. Off balance sheet liabilities also are a cause of concern. Revenue shortfall may not be fully met from increased economic activity but a fair amount of increased economic activity could help reduce the fiscal deficit. However, these measures suggest that the attitude of the government is pro growth.

3. Confidence is the key

It is always argued what causes recessions or global financial meltdowns? Is it debt? Is it structural shift in the economy? One thing always comes out is that the human optimism and pessimism are the key in turning economy. Since last three quarters, investors and businessmen turned pessimistic which aided in the fall of the growth rate. Now with such confidence boosting measures we will see a shift in the attitude from pessimism to optimism. What remains to be seen is that the government will have to deliver on the promises on FDI fronts and create jobs. It can only happen with the measures India is taking now. If FDI flow increases, there will be a natural phenomenon of increased confidence in the state of the economy. Infrastructure push remains absolutely important. This will in turn benefit in improving the growth rate. Plus, improving the way tax collections is done and bringing more transparency will help. Savings may remain a problem for sometime until incomes rise and compensate for the lost savings in last few years. Consumerism is on rise but importantly if India receives FDI, lot of high quality jobs can be created.

Conclusion

Global message has been sent. India is ready to undertake its transformation. Realising a $5 trillion dollar economy is not a dream anymore. It’s a commitment India is willing to make. India is pro growth and investor friendly. All India needs now is capital and risk taking. It is a huge gamble which the government has undertaken and its a good one. Opening up markets further, helping reduce tax burden, making procedures simple and building infrastructure is the need of the hour. Its the leap of faith now companies have to make.

Leave a comment