India’s debt problem isn’t new. It just keeps repeating itself. Time by time we see Indian corporates getting involved in some scam, end up in bankruptcy due to high interest rates or close down due to poor financial management. It’s not the problem of corporates alone. Government itself, is also responsible for the misfortunes of the debt market but when you look at it with a holistic view, it becomes even harder to put blame on anyone for the misfortunes of the debt market in India. India cannot develop itself unless it develops its debt market. Going by this, the ruling party is trying everything it can to develop banking and financial market in India. It has taken risk and delivered on those fronts. The government’s intention to provide banking to every unbanked citizen will help increase savings and capital formation in the country. One can even hardly dispute this claim, “the number of people with bank accounts grew from 53% in 2014 to 80% in 2017 — it is not enough. As many as 191 million Indians over the age of 15, are still without a bank account. The figure places the country next only to China where roughly 224 million Chinese above the age of 15 do not have a bank account.”quoting the Times of India. The jump in the number of bank accounts and when comparing it to China, we can see how serious the government has been to bring formal ways of finance to every citizen. This progress is great but not enough. India is stuck in a classic problem. Maximum Indians don’t earn enough income which can be saved so the marginal propensity to consume(for those who don’t know what this is- it means ratio of change in consumption to change in income) is quite high(est 0.7 according to Financial Express). Even after spending so much amount of income, they still don’t have a decent lifestyle. So whatever we earn, about 70% of it is used up in consumption. This leaves 30% of the income to be saved for capital formation.

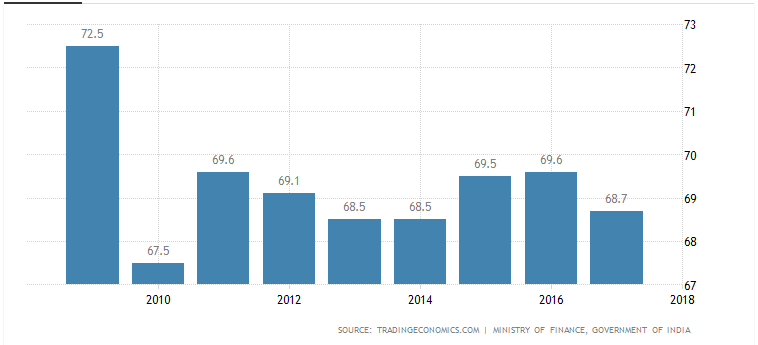

Let’s put things into perspective, India’s savings rate is declining, according to CEIC. It went from a high of 37.8% in 2008 to 30.5% in 2018. Meanwhile, Government is increasing its own spending. This year alone government expenditure is expected to rise by 8.87%, according to LIvemint. So the proportion of savings as a percentage of GDP being transferred to the government has increased. Now add the woes of the corporates in India. Many corporates like IL&FS, DHFL, Cox & Kings,etc have defaulted on their debt obligations. This has tarnished the image of the corporate debt in India. Crowidng out effect due to increased government spending and corporates themselves defaulting has created a drag on the economy for debt market. So what can be done?

1.Use foreign debt

Government has initiated foreign borrowing with this Budget. It has said it intends to borrow upto $10 billion dollars or close to 69,000 crore rupees(based on current exchange rate) to fund its expenditure. The problem with this kind of borrowing is the exchange rate. If a country employs foreign debt it can become as an added risk if the currency depreciates too much. India’s foreign exchange reserves and low interest rates globally currently provide some comfort to compensate for this added risk. This will free up upto 69,000 crores of savings in domestic economy for business lending. Also, it will reduce the interest rates in the economy. Internationally, we are seeing central banks cutting interest rates as economies are slowing down globally. The US Federal Reserve is expected to cut rates in its next meeting by 25bps. Reserve Bank of India is also going to cut rates going forward as economic growth slows down.

2. Privatise all banks

Government of India can consider privatising all the PSBs of India. Each year, government has to engage in recapitlising the public sector banks and other failing PSUs which violate corporate governance norms or collude with the corrupt promoters and cause value destruction in the economy. These funds become an added cost to the economy which goes from taxpayers’ pockets. Major developed economies of the world except for China don’t interfere in banking and leave it for the private players. Privatising banks will help reduce NPAs(non-performing assets) as profit becomes their sole objective. This may become a hindrance to the development of rural India but we are seeing increased penetration of new age fintech NBFCs with great execution serving the unserved with financial services and delivering in rural India as well. Lately, lot of NBFCs engaged in rural markets are receiving funding from venture capitals to grow their operations. India’s disposable income is rising and there are way better private players with better technology than PSBs who can serve the rural market of India at cheaper costs. It has been a long time since PSBs were allocated to serve the Indian subcontinent but they have failed to reach their objectives. Gross NPAs stand at 9.0% currently for the whole banking industry and major chunk of it comes from the PSBs. Meanwhile, private sector is growing at a rapid pace and reporting considerably low NPAs as compared to PSBs. Plus, privatising PSBs will eliminate or help reduce sources for corrupt corporates unless they make their financial situation better.

3. Structural improvements in the financial market

Major improvement is needed in the area of monitoring financial stability of the economy. The way IL&FS crisis has unfolded, it has brought into focus several shortcomings in the financial sector. Commercial paper market has dryed up for NBFCs which has caused slowdown of the economy. When banks were dealing with their NPAs, NBFCs were helping grow the economy. They were engaged in lending and took more risk than banks thus helping reach new customers. SEBI has introduced mechanism of default probabilty for credit rating agencies which means they will have to assign default probabilty on each debt paper. Additional reporting requirements for systematically important finance companies could help improve and monitor financial situation in the economy.

Making financial market efficient and better is important because it will help reduce interest rates in the country. High interest rates are charged even for good companies. This reduces the room for capital accumulation and profit. Many projects have returns which are low and give a very small room for corporates to make money. Reducing interest rates will have multiplying effects as projects earlier considered risky due to low returns will become financially feasible. US operates at a rate of close to 1-4% on average(last 20 years). Projects with low margins become financially feasible meanwhile in India it varies considerably time to time, this reduces the room for companies and increases the risk of default.

Leave a reply to revitalize finance Cancel reply