Indian skies has seen several name changes over last 20 years. Two names have stayed the same throughout – Indigo and Air India. The execution and management’s conservative attitude is the reason that InterGlobe has continued to remain one of the most profitable airlines with a market share of 65% as of February 2025. Industry’s own fatal mistakes are also the reason the airline has seen its execution payoff. In this blog, we will look at Indigo’s strategy, financials, competition and future outlook from the perspective of an investor to understand the business.

P.S. – This article is purely meant for educational purposes. Do not consider any conclusions from this blog as buy or sell decisions. Please do your own independent research for investment purposes. This blog is not responsible for any loss in investment by the reader. As a disclaimer, the writer of this blog holds an investment in the given stock.

Industry outlook

Indian aviation sector experienced a full recovery in FY24. It is the third largest aviation market in the world. The sector surpassed pre covid-19 levels by carrying 10.3% more passengers in FY24. Total domestic passengers carried in CY2024 stood at 161 million as compared to 152 million in CY2023. India’s international travel demand stood at 69.7 million passengers in FY24 vs 69.5 million in FY19. Covid induced travel restrictions severely impacted the international markets. India has doubled its operational airport count from 74 in 2014 to 157 in 2024. India’s seat per capita continues to remain significantly under penetrated with 0.13 seats per capita vs Untied States’ 3.09 and China’s 0.5. Indian aviation industry will continue to grow slightly faster than GDP growth. Aviation industry is a cyclical industry by nature but also can be seen as a consumer discretionary industry due to the nature of flying either for business or leisure. GDP growth has a strong influence on airlines’ revenue growth as both are strongly correlated.

Indigo’s stock returns vs Nifty

Indigo listed on November 10, 2015 at a price of 856 rupees per share. Shares were offered at a price of 765 rupees per share. Nifty settled at 7,780 points on November 10, 2015. Since then Indigo has gained 5.58 times to 4,780 rupees per share on March 17, 2025. Nifty in the same time has gone 2.89 times. Interglobe Aviation has comfortably outperformed Nifty 50. Aviation industry is notorious for bankruptcies but this stock has minted money for its investors despite the volatile nature of the industry. Indigo has continually gained market share and is now well placed to capture demand over next few years.

Indigo and the low cost model disruption

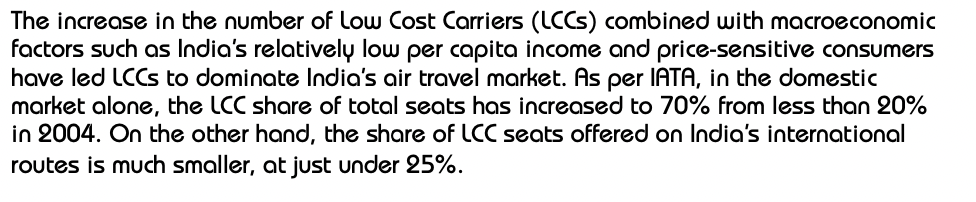

InterGlobe Aviation was founded in 2005 by Rahul Bhatia and Rakesh Gangwal and started its operations in 2006. During the same period, we had other airlines like SpiceJet also enter the market. Indigo is predominantly focused low cost model of airline operations which made its product offering different from what Jet Airways, Air India and Kingfisher offered at the time. Its model has always focused on low price, hassle free service and on time performance. What made it different is the fact that being a low cost carrier model the airline is only focused on getting passengers from one point to another without much service, fast turnaround times and standardised fleet. Anything over and above flying, like food or in flight entertainment are out of question unless paid for. This marked the start of first disruption in Indian aviation market as before that competition in that respect was never truly seen. Jet, Air India and Kingfisher were predominantly focused on offering full services. InterGlobe’s first order for aircraft was placed in 2005 with an order book of 100 A320 family single aisle aircraft. Since the start, the company focused on scale and with good reason which we will see later. Low cost carriers now dominate the Indian skies with Akasa now offering ultra low cost service on its route. When Indigo launched low cost carriers had a market share of close to 6-7% based on Jet’s IPO prospectus. As of February 2025, low cost carriers constitute more than 70% of market share of airline industry in India with Indigo predominantly holding the majority.

Masterful execution?

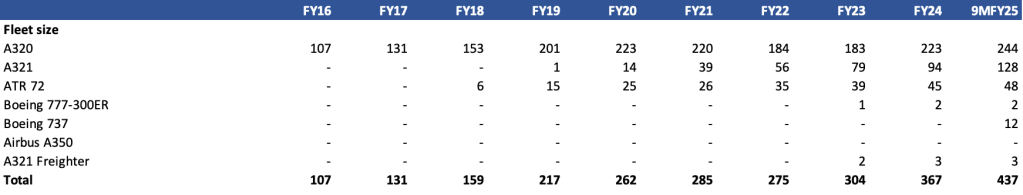

First let’s understand what things are relevant to an airline business. Fleet size and composition, age of the fleet, order book, network, domestic vs international mix, financing, an active secondary market for aircraft leasing and trading and competition. Big fleet size and standardisation is extremely critical from a low cost carrier’s perspective. Same aircraft across entire fleet can pay dividends as all pilots have to be certified in same aircraft type, discounting with OEMs becomes easier as order sizes are big enough to dominate delivery timelines for years and it becomes easier for operations in case of disruption due to aircraft issues as they can be swapped easily. Network planning also plays a critical role as aircraft utilisation has to remain high and network density can create multiplier effects as airline can offer hassle free connections and also able to fill flights which could otherwise go empty. A well connected network means customer doesn’t have to book any other connecting flight separately. Lower the age of the fleet the better as the airline doesn’t have to face downtime and face huge maintenance costs which is associated with older aircrafts. It also adds to the cost as the time aircraft spends at ground leads to lost revenue and poor customer service in case of older aircraft where interior may feel outdated which requires another big round of capex to modify and replace the interior. Domestically yields are lower for airlines vs international so international network offers a chance to improve margins and compete better if complemented with a strong domestic network. An active market for aircraft buying, selling and leasing becomes central to airline’s fleet strategy and different aircrafts can offer different type of liquidity which directly impacts ability to grow, utilise aircraft well and sale of older aircraft.

Keeping above things in mind, Indigo has created a perfect recipe to corner the market in present and future. Indigo’s first bold move to order 100 A320 aircraft indirectly has become central to success given management’s ability to absorb these aircraft efficiently in the fleet. To put things into context, in 2005 Jet Airways had just listed and had a fleet of 42 aircraft while SpiceJet had just commenced operations and had a total order book of 20 aircraft with Boeing. Air Deccan had only 11 aircraft and Air India group had highest with 62 aircraft in fleet. Total aircraft in operation at the time based on Jet’s IPO prospectus puts it at 135. Ordering 100 aircraft in one go by anyone’s thinking would be nuts. It required vision on the part of the promoters. Ordering almost entire capacity of India in one go is unthinkable. Of course delivery was going to happen over next decade but absorbing entire capacity into market profitability would bother any management. Ordering 100 aircraft also got Indigo big negotiating power with Airbus which at the time was desperately trying to battle Boeing to gain market share in India. Indigo received hefty discounts going by few reports in media. A A320 priced at $35 million dollars for most loyal customers was sold to Indigo at $25 million. Since the start, Indigo looked to built a dense domestic network with low fares, standard fleet and decent and basic levels of customer service. India’s geography has also played a role in its success as most flights in India have short duration where customer is more focused on basic service rather than full service or expect a luxury experience on ground with first class lounge for a 1 to 3 hours flight. This made more sense for international medium to long haul flights where services required might increase considerably and lower fare might bring a bigger trade off with comfort and services. Indian market was fundamentally different from American and European markets thus following playbook of Western airlines could be inherently disadvantageous. Indigo got big negotiating power with Airbus, ability to price fares lower than competition and also control of its fortune. Going with the A320, it offered Indigo an active market to clear out older aircraft as well which is essential to keeping costs under control. Indigo usually keeps aircrafts on average for 6 years in its fleet before returning them to lessors. Average age of fleet is somewhere around 3-4 years right now for the airline. Indigo doesn’t own the aircraft as it takes delivery at lower cost and sells the aircraft to lessors. Thus Indigo got a big head start in cost, competitive intensity and network in the domestic market.

Stroke of luck and poor competition

A big stroke of luck Indigo has found is with poor balance sheets of competitors, lack of proper maintenance of aircraft on competitors’ fleets, management failures and failure of Boeing. Airline industry in India has been to painful to all airlines in India. Extremely high cost of operations, highly price sensitive customers, lack of competent staff, ill mannered customers leading to staff stress and negative publicity and slow pace of infrastructure development. Indigo found its luck in Kingfisher’s bankruptcy due to poor debt management, same with Jet and Go Air bankruptcies where overnight players went bankrupt and supply evaporated from market. Indigo continually gained market share with major bankruptcies. Air India has such a poor track record of customer service and aircraft maintenance which leads to constant social media publicity negatively. Naturally, this has left considerable amount of open space for other airlines to compete and Indigo is well placed to capture this demand. Air India and SpiceJet both are sitting on older aircraft which are in dire need of maintenance and refurbishment which will end up taking years due to sheer number of aircraft and cost involved. Even full service carrier space is now open for competition, Air India CEO has come out and said publicly aircraft shortage is set to last for 4-5 years. So anyone who has already ordered aircraft is taking the market share.

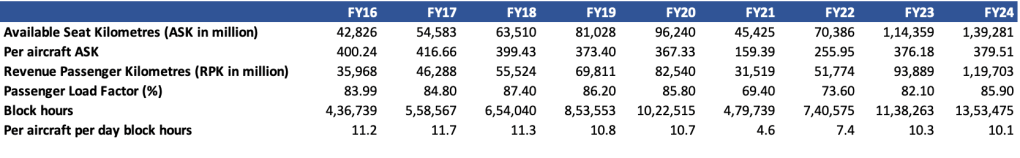

Indigo has a market share of 65% in domestic market. Air India commands a market share of close to 27% and Akasa around 4.7%. I have not taken other airlines because they don’t offer any strong competition as of now or are operating in niche regional markets. Indigo has a strong domestic network with significant monopoly on routes based on previously reported news articles. Air India is still in the process of expanding capacity in domestic network. (Data on routes is not available freely so will recommend readers interested to look it up themselves on the internet.) Indigo is looking to expand international network as it is more lucrative yield wise, offers faster capacity expansion and helps capture entire customer journey. Indigo’s current international flying was restricted to upto 6-7 hours of flying time which is set to change as new aircraft come in. International market offers higher yields and available seat kilometres due to higher service requirements, wide body jets usually have higher number of seats in the zone from anywhere around 280 to 550 seats and fly long distances.

Capacity expansion

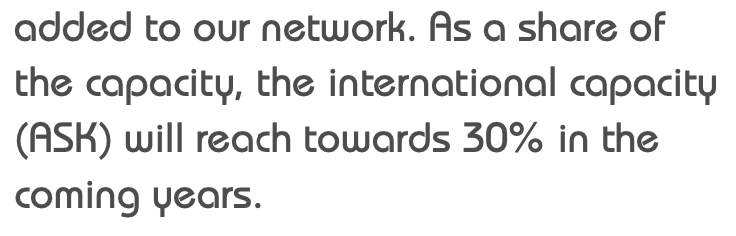

Boeing in its commentary has mentioned delivering on average 2 planes per month for the year 2025 which means total deliveries of 24 aircraft to Air India and Akasa combined while Airbus will continue to try to ramp up its deliveries of A320neo family. This puts Akasa at a structural disadvantage. Air India and Indigo both have Airbus order books although Air India has about 340 aircraft to be delivered while Indigo is sitting at a staggering 930 aircraft yet to be delivered. Akasa has about 199 more planes on order with Boeing to be delivered over next few years while Air India has about 185 aircraft left to be delivered from Boeing side. Majority of this capacity is going to come towards single-aisle jets which serve domestic and short haul international routes. International medium and long haul Air India has a strong position due to its wide body fleet. Currently, Indigo and Air India both are under capacity constraints. Air India remains under capacity constraints as it is busy refurbishing its fleet of both narrow body and wide body aircraft which are out of service. Indigo also is currently facing issues with engines on its fleet leading to grounding of 60 aircraft which management expects to gradually reduce over next one year. Indigo is expected to induct its first A321XLR this year which will open up new routes which could be strategic in nature and give Indigo an edge or monopoly in few international routes for now. Indigo is also going to induct few 787 on wet lease basis this year to capture international demand coming out of India and to compete with Air India. It will start receiving A350s in 2027 which shall open up even more markets like North America and Europe. 787s also offer this capability and Indigo is set to use this for aircraft for European routes temporarily. Indigo has deployed first of this aircraft on Delhi-Bangkok route. Indigo’s current fleet size is expected to double by the close of this decade which means close to 700-800 aircraft in the fleet. Indigo updated its guidance on international capacity expansion to 40% of total capacity by 2030 vs earlier target of 30% in short term.

Revenue and pricing power

Indigo has seen its revenue climb at almost 20% CAGR basis from FY16 to FY24. Indigo has seen total revenue go from close to 16,100 crores to nearly 69,000 crores in FY24. In the same time, yield or pricing has only climbed 3.33% on CAGR basis. Yield is basically passenger ticket revenue divided by revenue passenger kilometres or price per km of distance flown per passenger. It doesn’t include extra revenue gained from selling food, beverages or providing any additional services to passengers. More or less the split between passenger ticket revenue and additional revenue from ancillary services and products has remained the same. Passenger ticket revenue made up 87% of the revenue in FY16 which has remain unchanged at 88% in FY24. Ancillary revenue at the same time has seen slight drop from 12.40% in FY16 to 9.55% in FY24 as other part of the revenue has taken a slight share which I expect to reverse going forward as this revenue includes compensation from Airbus for grounding of aircraft due to ongoing engine issues with its fleet. Entire growth recorded by Indigo has come from volume expansion as can be seen from nearly smaller change in yield. Yield has more or less remained under pressure in India since early 2000s. Pricing power is purely dependent on the capacity, customer’s sensitive to discretionary spending and costs to put that capacity. Air India currently has older fleet which may lead to higher costs but over time with new deliveries they will also see reduction in cost base. Indigo should continue to maintain cost leadership which means it can drive pricing as well. Indigo has also started shedding its budget airline image by pushing into business class travel between major cities of India and looking to start international long haul and ultra long haul which offer higher yields than domestic market. A321XLR could offer very strong opportunities in terms of network building. Indigo has set a target to take international capacity share to 30% in near term. You could end up seeing unique flights which may not have been possible before like Bengaluru-Tbilisi or Mumbai-Seoul. These are just examples, not something Indigo is actually doing or might have done.

Costs and Profits

Biggest expenses for an airline includes aircraft acquisition, maintenance & repair, fuel costs & human capital. These expenses can look different based on which region’s airline you are looking at. American companies usually show a higher expense on human capital side than fuel side as compared to other regions. This may mean not an apples to apples comparison on an international level. Lot of it also has to do with the mix of revenue getting driven by premium offerings, level of service offered, local taxes, import taxes, etc. In India, fuel cost is about 35% of any airline’s revenue, while rental and maintenance could be anywhere from 15-17% and human capital cost is around 9-13%.

Indigo’s gross margins are more or less highly dependent on fuel costs as compared to other costs. In FY23, fuel costs made up 43% of revenue vs long term range of 35%. As the costs fell you can see gross margins improved significantly. Almost entire improvement in gross margins has come from reduced fuel expense as a percentage of revenue. I expect fuel costs to remain somewhere around 32-35% over next 2 years due to economic slowdown and OPEC’s pledge to improve production which should support gross margins for Indigo. In the latest quarter of Q3FY25, fuel costs made up only 29% of operating revenues. This line expense can single-handedly decide the prospects of the airline. EBT margin has improved from -0.69% in FY20 to 9.35% in FY24. I expect this to remain in favour for Indigo and slightly improve as well. I have taken EBT margins as a measure of operational performance because of accounting rules.

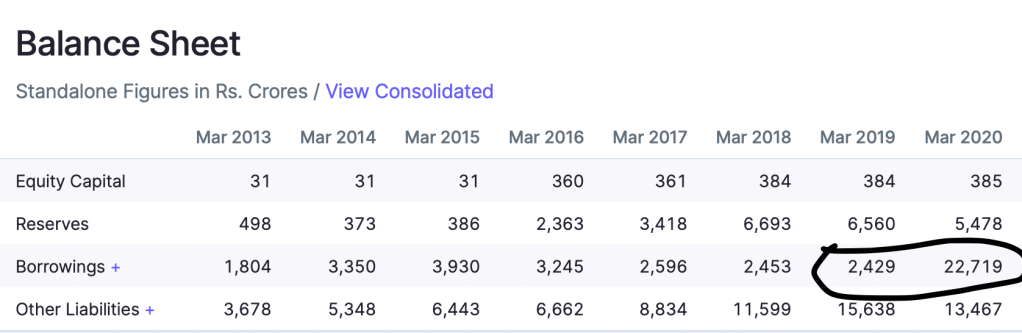

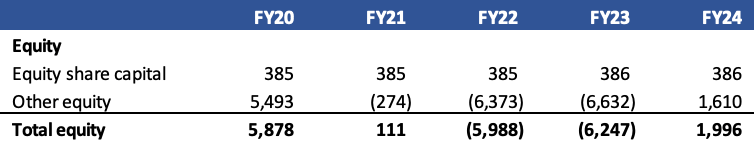

Due to accounting changes in financial statements, FY20 saw Indigo recognising its operational leases as financial leases which has led to creation of debt on its balance sheet with a commensurate entry in the side of assets with right of use assets. Indigo is objectively debt free with some aircraft sitting on finance lease. This led to artificial escalation in interest costs and depreciation charges which impacted EBIT and EBITDA. Hence, I take EBT before foreign exchange loss and other income as a more truer form of operating performance for Indigo. Coming to profitability ratios, one has to put economic environment and balance sheet’s condition before taking high ratios as given. Covid-19 caused a significant dip in business operations and completely eroded net worth of Indigo.

Post Covid-19 and fall in crude price has brought the airline back in black and made net worth positive. Indigo reported a profit of almost 8,200 crores in FY24. This single year completely reversed the negative net worth of the airline. Even losses sitting in tax books is providing a lift which should completely reverse in FY26 and tax outgo should normalise by FY27. The low base effect of net worth is impacting the return ratios as of now and I expect it to eventually settle at normal levels once the base attains sufficient size commensurate with its business. Return on Equity should more or less be around 76% for FY25 vs 409% in FY24 and should keep going down. Mind you, this will be accompanied with improving EPS as well. Indigo is currently generating quarterly profit of 2,000 crores and should see improvement as the fleet expands, product mix improves and rupee depreciation flattens out. Another proof of airline’s strong profitability is in adjusted CFO/EBT. In FY24, airline had an adjusted CFO/EBT of 175%. This is more normalised and provides a far better picture of cash generation than return ratios. I have taken adjusted CFO due to accounting changes related to leases which pushed lease expenses into principal repayments and interest costs to financing outflow vs operations earlier. Therefore, I have reduced cash flows from financing from operating activities to give reader a better idea about the business and its ability to generate cash. Lot of it has to do with Indigo’s focus to keep asset light balance sheet using sale and leaseback mentioned earlier, avoiding debt fueled expansion and airline business’ natural character of taking cash before delivering services. Also I want the reader to know, Indigo’s disclosure on profits focus on EBITDAR, EBITDA and other facts. I don’t like to focus on EBITDA simply because depreciation is a cost to business and prefer taking EBIT as operating profit margin. In Indigo’s case due to accounting rules, I have taken an even more stringent metric of EBT because I think that is way more fair. (Obviously, you are free to choose to focus on EBITDAR but my focus is profits after all costs but before returns to capital providers. Any asset whether financed through self or lease is a cost to business and capital providers only get returns after accounting for these costs. You are more than open to disagree.)

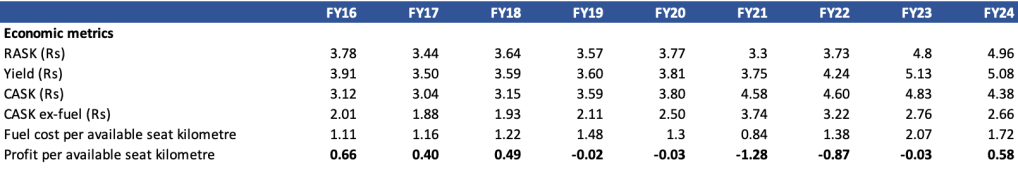

There are other metrics as well. They give a view on the unit economics of the business. Much like hotel industry, Yield is like average room rate. Yield is price per kilometre flown by a passenger. RASK (Revenue per available seat kilometre) is like RevPAR. It is basically calculated as passenger load factor multiplied by yield. It also includes all other forms of revenue and can sometimes be higher than yield. The total revenue figure in P&L includes all operating revenue. CASK is basically cost per available seat kilometre. It is calculated in two forms one is with fuel and other is ex of fuel. Ex of fuel is a much better measure due to volatile nature of fuel. Like I said, an airline can have an extremely low cost base vs competitors but still post loss due to crude prices. Our focus is on CASK ex-fuel. Indigo’s strong focus on cost and efficiency can be seen in CASK ex-fuel. From FY16 to FY24, CASK ex-fuel has only moved from 2.01 rupees to 2.66 rupees in FY24. That is a CAGR of 3.56%. Profit per available seat kilometre (RASK-CASK) is still down though from 0.66 rupees in FY16 to 0.58 rupees in FY24 as yield climbed only 3.33% on CAGR basis in same time period.

There are certain triggers in business which should provide efficiency boosts and upside surprises. Indigo’s management has repeatedly mentioned inefficiency of aircraft usage due to congestion at major airports like Mumbai and Delhi due to capacity constraints. New airport openings at Navi Mumbai and Jewar should unlock capacities and efficiencies which should reduce fuel burn thus translating into more profits. Indigo’s entry into business class segment should also translate into upside surprises in yields. Indigo plans to eventually fit less than 10% of its fleet with its new business class product- Stretch. Despite the inefficiency, Indigo’s block hours per aircraft are down from 11.2 in FY16 to 10.1. Block hours is time from aircraft gate closure to gate opening post landing. Indigo’s efficiency can be further increased by one hour per aircraft per day. It may or may not be possible based on yields also as it increases capacity by 11% in one go. The increased utilisation can also lead to lower CASK ex-fuel. There is also an opportunity to lower CASK ex-fuel if Airbus is successful in resolving aircraft groundings and Indigo is able to give back aircraft it has taken temporarily from other airlines like 737 to expand capacity.

Risks

Aviation industry and stock market both are fraught with risks. There is always the risk of underperformance of the stock or the company itself giving downside surprises. Donald Trump can undertake policy measures which negatively impact India which could pull down demand and yields of the industry. Fuel costs are currently favouring the industry and could favour industry but crude is also extracted from Middle East. Any flare up in Middle East will pull the airline into losses again. Air India is aggressively expanding premium offerings in domestic route network to capture premium travellers. Air India has started offering premium economy also which is positioned between business class and economy. Indigo has not shown any interest to do the same. Delay in aircraft delivery due to supply chain woes could impact capacity expansion and push up costs. Any opening up of capacity at Boeing and Airbus will also be detrimental as space for another carrier could open up. Indian economy is also facing pressures right now due to slower growth and high debt of households.

-Shivang Agrawal on WordPress

Leave a comment