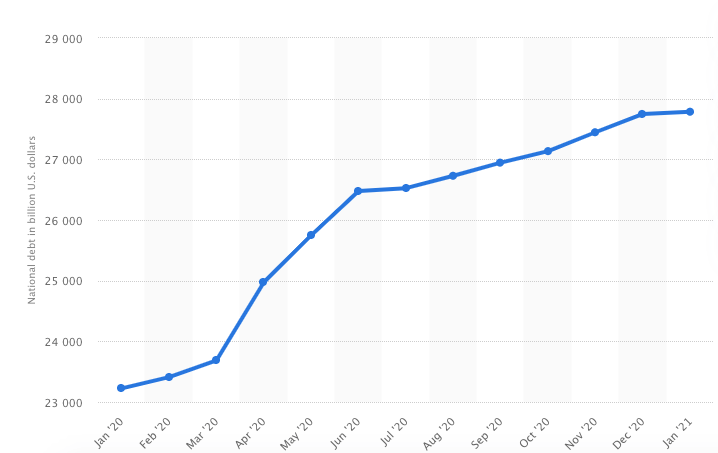

2020 left global economies visibly shaken. The West was hit hard, US is still fighting the collapse and chaos caused from the Covid-19 pandemic. UK is still facing series of lockdowns. To rescue their economies, US and Europe undertook big fiscal and monetary measures. Just to give you an idea about the scale of the stimulus in US, 20% of US currency that exists today came into being only last year(as per October 2020). As per latest reports, this number stands at 40%. No wonder the dollar is under pressure. On the fiscal side, US national debt increased from close to 23 trillion dollars to 28 trillion dollars in one year due to Covid-19 response.

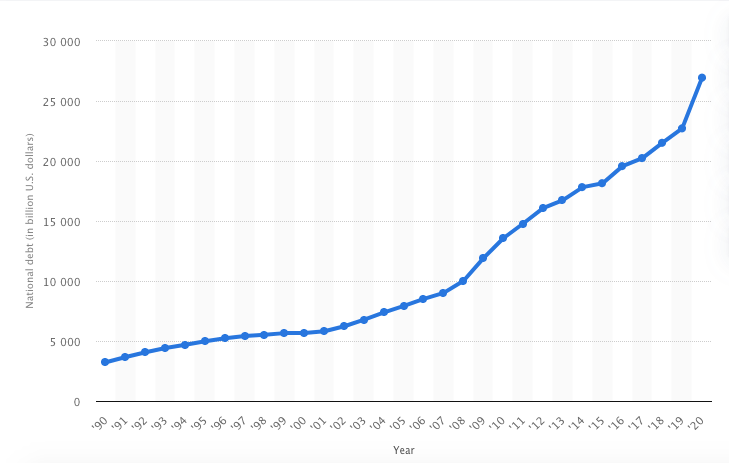

To give you a comparison, see the graph of US public debt increase before pandemic struck.

The spike in 2020 shows the plight of US policymakers to save the economy. Anyway, now as vaccination progresses, we seem to be entering into a multi year bull run especially for emerging markets. China reported positive growth for the year despite being the first country to get hit by the virus. Chinese economy grew by 2.3% as the year came to an end. India is projected to grow by 11% in FY22. I am more concerned about Indian context as I am an investor in Indian markets so I am gonna cover more on Indian markets in this article.

Is it a bubble or a sustained rise in stock markets?

I think the recent mouth watering rise in the stock market is justified especially from the Indian context. As the pandemic hit India, lot of companies begin a multi year deleveraging program to reduce stress on their balance sheets. Not only that, companies also undertook cost cutting measures at a big scale which is evident now as many companies have reported double digit growth in profitability. Thirdly, as the pandemic begin receding and economy opened up, the demand for all types of products barring hospitality and travel sector, reported strong growth numbers. Auto sector which has been badly hit since October of 2018 has started posting good numbers and the demand seems to be sustaining as of now. Other sectors like IT, banking, cement and steel also reported good numbers which have increased the investor sentiment. Meanwhile FMCG sector reported higher growth in 2020 compared to 2019 despite the fact that March and April saw country under lockdown. RBI on its side has done a great job to keep yields low although they may come under pressure as GoI undertakes fiscal consolidation over a longer glide path. It makes sense as GoI has gone for a pro growth budget to revive the economy. Looking from the valuation perspective, Indian markets seem to be richly valued but calling it a bubble is a mistake when the factors in the economy are overwhelmingly positive. The reason is that these valuations will sustain and are representative of Indian economy a year from now.

Its time for capex

2020 saw world changing their perception of Chinese economy and leadership. This was evident from the plans of Apple, the world’s most valuable company. Apple has already begin the process of diversifying its production of products. Central to this strategy was moving some production from China to India and Vietnam. In support of this strategy, lot of suppliers have now started emerging in India which otherwise would have not set up shop in India. In fact, Indian conglomerate Tata is investing 5,000 crore rupees to supply Apple with iPhone components. The launch of PLI scheme in other sectors as well and a low tax rate for manufacturing units is a positive for capex cycle. Even Indian companies have started announcing new investments to increase their production. Note worthy of these include UltraTech cement’s capacity expansion. Government of India has also focused on capex spending in this budget and has increased their spending by 34% for capital expenditure which will help India get back on pre Covid trajectory of growth. Meanwhile, on the other side, GoI has increased infrastructure efforts which will help bring down the cost of logistics in future. India has the highest logistics cost as a percentage of GDP at 13-14% of GDP when compared to advanced economies which are at 8-10% of GDP. Currently, Indian logistics is uncompetitive and with upcoming investments like Dedicated Freight Corridor the cost of logistics is going to fall.

Other factors

The overall economic environment is favourable. With interest rates at record low levels, fiscal stimulus and general adjustment of life to the new normal seems to be working fine. What is rather difficult to see through is how the future is gonna unfold. With US and Europe struggling to grow and at the same time increasing debt and money supply, inflationary pressures and also a risk of rising interest rates in future could dampen the growth prospects of West. Asia meanwhile continues to roar ahead as it is considerably less affected by the pandemic compared to West. India is entering a multi year bull run where schemes like PLI, infrastructure spending, reduction in cost of doing business and also improvement in laws could provide a good boost from structural perspective. Other positives like the formation of a bad bank for PSBs and government reducing its business exposure by either shutting down or selling off PSUs could open up vast amount of resources which could be spent on education, healthcare and building infrastructure. All in all, I think with such improvements India is opening up itself to higher growth as government focuses more on its own core functions. India’s entrepreneurial spirit also seems to be strong with multiple new era businesses like Ola, Flipkart, Zomato and numerous other setting a great example of India’s ecosystem being able to deliver high quality startups. It would seem like a mistake to stay out of the market. However, investing should always be done with some sense in the valuation.

Shivang Agrawal on WordPress

Leave a comment