This week has been absolutely brutal, merciless and cruel for investors globally. Each and every asset has shown very extreme moves which were unprecedented. Markets have been unstable and caused huge losses. Almost all markets have declined more than 20% now. Oil fell by more than 30% after Saudi Arabia vowed to open its taps. Bond yields declined globally as money rushed to safe haven assets. US Treasuries fell below 1% for the first time. All of this has caused huge discomfort. The only question coming to my mind is how is the market going look ahead? Are we headed for a recession? Or a V shaped recovery? Well, I put some of my thoughts into how I view the situation after the absolute mayhem.

New York Stock Exchange

1. Establish facts

Based on economic data and few other anecdotes, it seems this effect could last only for 2-3 quarters based on containment efforts to fight coronavirus and monetary policy measures. There has already been a recovery in China with the virus already peaking there. The Shanghai Composite declined only 1.5% when other markets hit circuit breakers and experienced more than 5% declines. China’s exports fell by 17.2% in dollar terms in the first two months. Chinese factories have already started operating but at a lower capacity of 35-40%. Wuhan has also shown recovery with Chinese President Xi Jinping visiting the Hubei province. I don’t expect much destruction in financial markets if governments, monetary authorities and healthcare authorities are able to fight the outbreak. With China showing recovery, I am confident this Black Swan event will be behind us. Monetary authorities need to extend loans to companies struggling to up keep their businesses. What’s more concerning is that many Indian companies still continue to trade at a high valuation which again goes against wisdom of valuation but investors being confident of the companies to grow at a very rapid pace. If containment efforts fail, I am afraid of many more stocks to fall with index suffering more losses. Germany has warned about the possibility of 2/3rd of its population getting infected. Germany is Europe’s largest economy. It could give a big blow to other markets as well. Meanwhile, US is facing a big crisis with New York declaring state of emergency. A blow to the US will mean financial disaster as many companies have taken too much debt and returned cash to investors. This is an evolving situation to be fair. It will be better to base decisions on economy and containment efforts.

Empty streets in China

2. Watch out for highly leveraged companies

Many highly indebted companies could face a severe cash crunch if containment efforts fail. Long term problems of companies may magnify and finally give a death blow to these. Check for any linkages they have to other parts of the market which could hit those companies as well. Indian economy is recovering and I expect recovery to continue slowly as the government contains the virus. India will benefit going forward as companies have already started diversifying supply chains after severe issues related to components scarcity due to over reliance on China. US-China war had already changed their investment plans. With coronavirus, they will be more inclined to move out of China and diversify. An environment of low interest rates, negative yielding debt and a booming stock market resulted into companies leveraging and investors speculating in the market which suggests many companies may continue to see their share prices decline substantially. Exercise extreme caution when investing for long term. Stick with known names, good managements(no compromise in any market condition) and do a very conservative valuation as growth rates of many companies are gonna take a good hit in upcoming quarters. Many economies still carry the risk of coronavirus which could hit demand or supply sides or both. Do a careful analysis of margin and revenue mix before buying these companies and watch out for any management commentary. JLR has already seen its sales crash 85% in China. Many companies will start gaining market share in coming quarters due to their competitive advantages. Keep a tab on market shares as good companies gain market share during turbulent times in their respective industries.

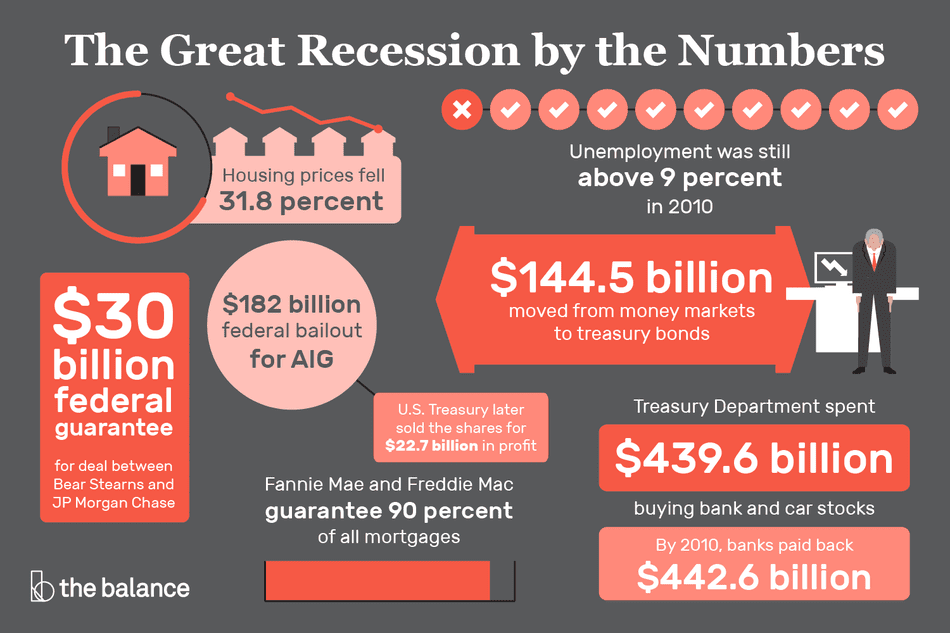

Sneak peek of financial crisis of 2008

3. Stick to quality and hope for the best

Stock market is a place where surprises keep popping up. It’s more psychological than economical in short term. Only thing which protects you from these surprises is quality. Quality in businesses always wins. Warren Buffett always prefers quality and this has rewarded him spectacularly. Sticking to quality right now will provide great returns in the long term. I expect a V shaped recovery if the virus is contained in major economies. I see this as a great opportunity to accumulate businesses for long term. I always prefer equity as they protect you against inflation and also deliver compounding returns. Valuation will ultimately save the day. Even quality stocks are hit but valuation protects losses. I have nothing more to add to this. I don’t believe this will last for long and even if it does, it is a great opportunity. Interest rates are gonna stay low for a while and share prices will command a premium in future. Financial models are not going to protect you today. Today, it is more of an emotional challenge than mathematical. Stay safe!

-Shivang Agrawal on WordPress

Source for images: Google

Leave a comment