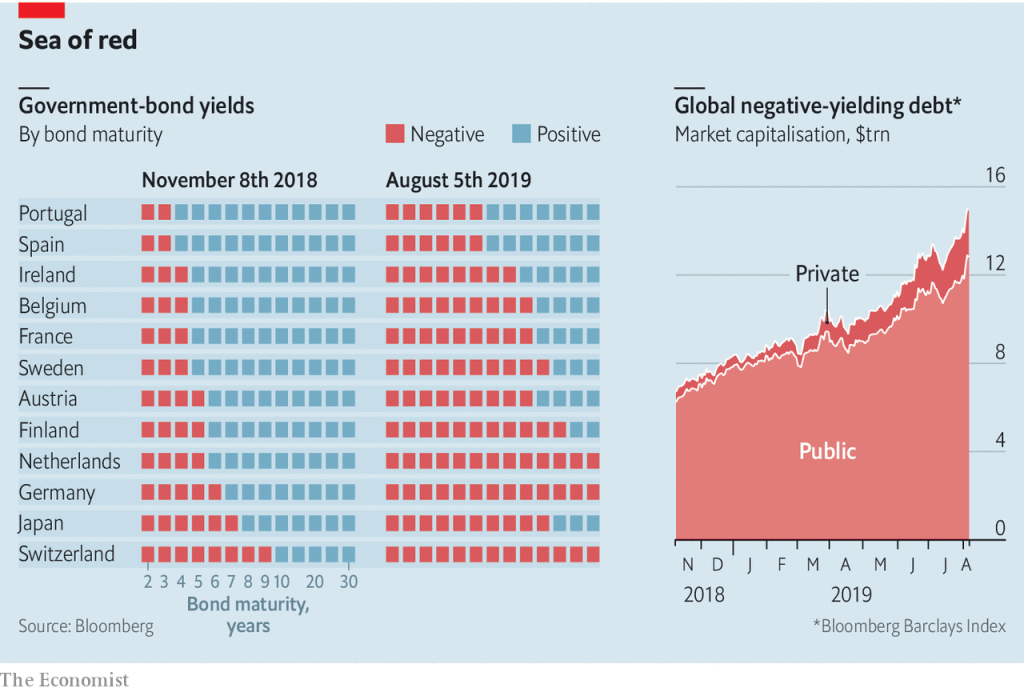

World has witnessed very low interest rates in last twenty years. Only developed markets have witnessed negative interest rates. Developing world continues to operate within the realm of normal economic models. Negative interest rates is surprising and unheard of. Today more than $17 trillion dollar of debt is trading negatively. Could it be a reason for worry? Or could it be an indication of countries fulfilling their economic objectives like providing fundamental things to its population like housing, clothing, access to education, etc. It is very hard to say but one thing is clear, as populations increasingly fulfil the basic and luxurious needs, the need to increase consumption will decline and cause interest rates to fall. Countries witnessing such fall in rate of increase in consumption may not be able to use monetary policy as a tool to address their growth rates. Increasing cash surplus with investors or lowering the interest rates might fail because practically there will be no need to spend that money anywhere unnecessarily in the economy.

Is it a bond rally due to increased risk or a new economic scenario

Well, for now it seems to be that consumers and investors, both the groups are being extra cautious than what we have witnessed in past 10 years since the financial crisis. The fund flows to bonds have increased tremendously in past 2 years. This article from Financial Times expressed the concerns over bond flows which pushed interest rates to negative as investors prefer more of debt due to safety offered by the fixed income assets. ‘About $487bn flowed into fixed income funds this year, up from $148bn in the first half of 2018, according to figures from Morningstar, the data provider. It is the highest level of first-half net inflows into bond mutual funds for at least a decade.’-Financial Express(I have provided the link here in case you want to take a better look at the article I borrowed the data from- https://www.ft.com/content/16c1fdaa-b094-3fe6-af7a-eb9883440974 another article which the investors can look at is from Investopedia- https://www.investopedia.com/gap-between-equity-outflows-and-bonds-cash-is-highest-since-2008-4774345). Economic scenario may also be partly blamed. Developed countries may have exhausted their economic resources to grow. Real factors like populations, market size, market development and other factors reveal the room for growth possibility and looking at developed countries suggests they may well be past their great cycle of economic growth. In economic theory as well, the growth comes from technology and labour force. Labour force in these countries are facing problems expanding from lower fertility rate, to lower immigration and protectionist policies. Technology continues to grow but to make a big economic transformation, you need a technology which affects big structural areas of the countries which doesn’t seem to be happening. Electric cars are coming but that may just shift the economic pie a little. Only other trend is artificial intelligence which has a long way to go.

Political risk is high

In the US, Donald Trump is facing an impeachment test. Meanwhile, populism is becoming more mainstream due to climate change and income and wealth gap. Future presidential candidates also present a big risk to US companies. Many have talked about breaking up the tech giants. Universal basic income scheme is also becoming more and more prominent. An unfavourable opinion about Republicans could dampen the prospects of seeing a Republican in the White House. The wave of populism could lead to US companies facing headwinds in their operations. Globally, countries have started trade war with each other to get their fair share. The integrated supply chains face an increased risk of getting higher tariffs on their imports and exports. In case the US-China trade war escalates it could lead to an increased chance of facing a downturn. It is a time ticking endeavour, Trump doesn’t have much time as the economy is suspected to be entering into recession as early as 2020.

This downturn could be bad. The longer the expansion, the greater the risks.

The upcoming recession could hit the US badly. With US-China trade war, Trump’s corporate tax cuts and the overvaluation of the US markets could lead to a hard fall. Under Trump, the government has increasingly used more and more debt to fund the growth of the GDP and this leaves really less fiscal room to for the government to counter the downturn. The current US government debt is at the highest since the World War 2. The Gross Public Debt to GDP stands at 106%. This doesn’t provide much room for the US government and makes it even more harder for the US to recover quickly from a downturn. The Federal Reserve may face issues due to lower interest rates which may not leave much room for it to counter the economic slowdown. One silver lining is the consumption driven nature of the US economy which could help counter slowdown in case the Fed chooses to use negative rates. One more plus point about this consumption, is that the American households have reduced their dependence on debt. ‘The ratio of debt to disposable income shows the same improvement in household finances since the Great Recession — down to 84.6% of annual income compared with 116.3% in the dark days of 2008 and 2009’ -Marketwatch. Another point of worry is the US corporate debt. (This article from Forbes gives a good idea-https://www.forbes.com/sites/mayrarodriguezvalladares/2019/07/25/u-s-corporate-debt-continues-to-rise-as-do-problem-leveraged-loans/#5bc9d0fa3596). Total US corporate debt is $15.5 trillion, 74% of US GDP. Of the $15.5 trillion of company debt, a little under 1/3 is in the form of leveraged loans and below investment grade bonds as per Forbes. Although companies are in a great shape, any downturn could trigger a chain of events which could lead to shrinkage of profit margins and hit the companies with high debt on balance sheet. The major concern lies in the BBB rated and below investment grade bonds. With the growth slowing, this could lead to bankruptcies in several companies. Debt levels are higher than they were before the 2008 financial crisis in the US corporates.

Conclusion

The risks from the coming recession are clear. The question still remains that, will the US and other developed markets really experience a recession? Many developed markets are facing recessions already from the likes of the UK to Hong Kong. Although they have local issues to blame, they could weaken the confidence of investors in other countries and lead to a self fulfilling prophecy. Managing risk at the moment carries outmost importance. That could potentially explain the investors’ run towards government debt for safety. Sticking to quality companies with strong balance sheets is a good way to stay invested in equities but again not being careful about paying a high price for the near term future is also not a good way to invest. Valuations should seem reasonable to warrant a purchase anytime. Buying bonds towards the lower end of interest rate cycle can depress the returns in the future and make capital appreciation that much harder. Holding cash also seems a great option when the markets seem to be harder to read. Sitting on cash is never bad if you are not comfortable with the risks in the market.

Leave a comment