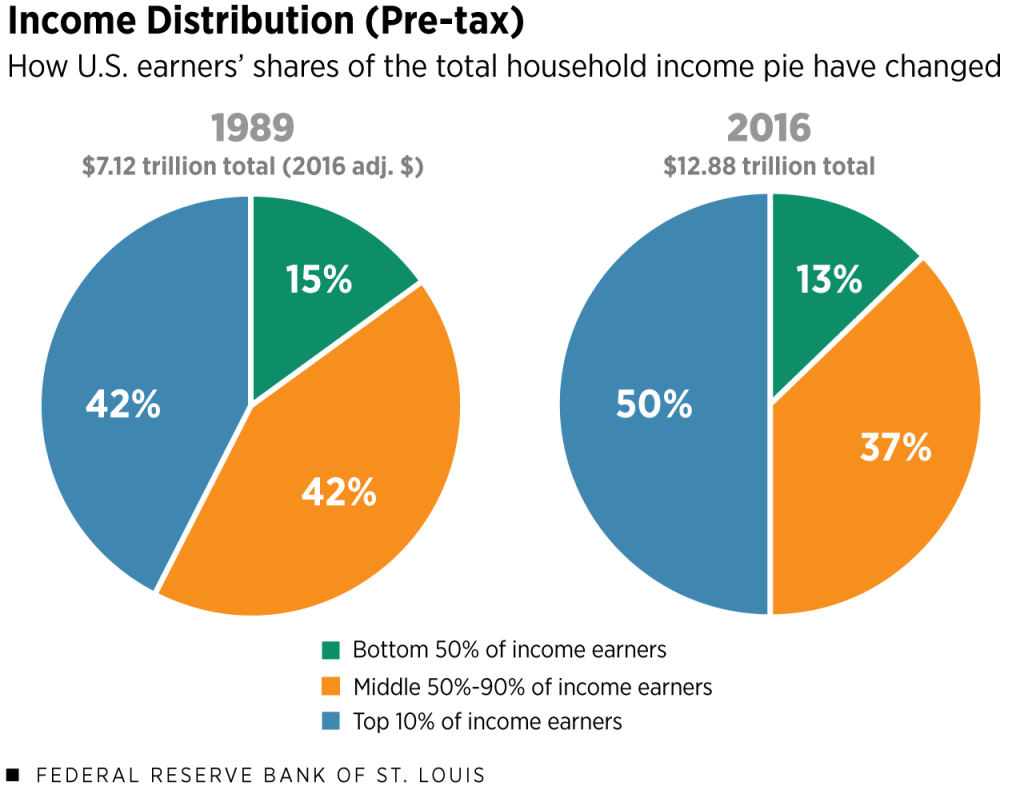

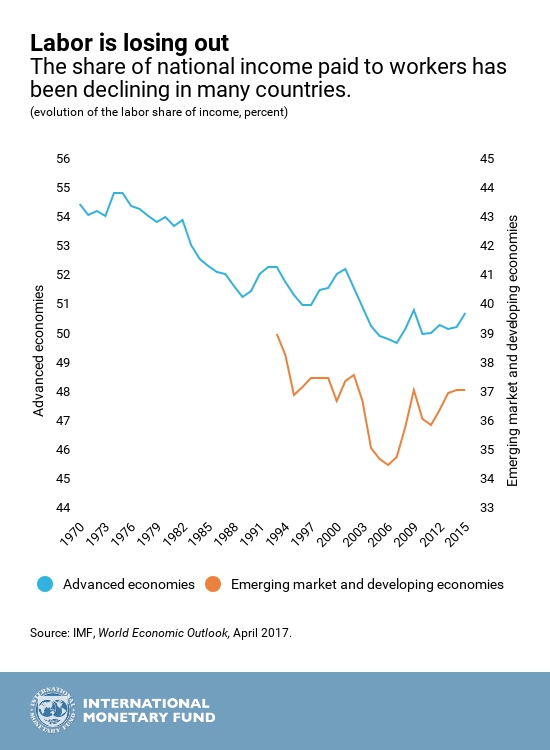

World has seen wealth inequality and income inequality spike. It is not the result of poor economics or poor policy decisions. It is a result of poor distribution of wealth generated by our corporations. You may name them public corporations but the significant pie of it stays with private hands and promoters. It is a result of ownership claim and reward which the entrepreneur receives for his initiative and hard work. Many billionaires have been minted by this basis, namely, Bill Gates, Jeff Bezos, Jack Ma and many more names. Nobody could have imagined different ideas and their execution could make them own as much as bottom 50% of the American population. Every two days one billionaire is created in today’s technology driven world. According to MarketWatch, richest 10% households in the US hold 73% wealth of the country. In India, the case is even worse, according to Business Insider, top 1% of India alone holds 73% of wealth of the country. This high skewness comes from the fact that entrepreneurs may have been overly rewarded for their initiative and business skills. Entrepreneurs are important to make economic leaps but it by no means translates into meaning that they have to be overly rewarded for their risk taking behaviour. In fact, they can’t take off without their dutiful employees, suppliers, customers and society who are willing to purchase their ideas and execution.

1. Change the distribution of equity

Let’s say the distribution of equity should be changed. No investor or entrepreneur should hold more than a fixed percentage of company. It could be based on market cap or some other relevant measure. Employees and suppliers could be more rewarded. Equity could be allocated more than today’s standards to these groups. This way wealth distribution from a successful venture becomes more equitable and just. After all, these employees have also contributed to the success of the company. This will produce more millionaires, more consumption and more innovation as the successful venture could lead to more entrepreneurs being born from it. PayPal is a great example. PayPal’s own value may not be high compared to tech giants but it has given birth to many multi billion dollar companies due to its employees’ entrepreneurial initiatives. The founders can be given differential voting rights to address their concerns related to management.

2. Change laws

Change laws to regulate the percentage of wealth the top households can hold at a given point in time. This way they will be fairly rewarded and also won’t lead to high concentration of wealth with a specific group. This way they will have to give away wealth which could be transferred to have nots or government and then they can use to fund their economic objectives. This has become necessary because today even higher skills don’t transform into high wealth. People may be living a high quality of life but they may not be able to accumulate wealth at a pace which matches the top 1%. This is because top 1% own top companies which yield top value creation businesses. This can be seen as Amazon, Google, Apple and other big tech names have started entering into different diverse areas of business which are not necessarily their line of business. For example, Amazon is now collecting retail data on its website to produce consumer products under their brand Amazon basics taking away share from smaller companies which can’t compete on quality and brand. All of this market power is leading to anti trust laws being used in the US to breakup these companies.

3. Teach money management

Schools only teach you how to get a job by leveraging your skills and building resume but getting rich is not a function of your skills. It’s a function of how well you manage your money. Teaching the kids the ideas about wealth and money management can help them start early in their careers and weigh their uses of money much better. Money management can become a mandatory subject for students so that they make more informed choices about how to manage money even before they pass out school or college. This way wealth distribution can be addressed. Rich people may not know the scientific process behind their company’s production process but they very well know how to deploy the capital that they have.

4. Use more labour intensive techniques

Adopting artificial intelligence maybe a mistake in part of global economies right now. If one nation adopts AI in a better way than the other country and with free trade we could face social issues. Developing countries could simply become unemployed because the developed nations adopt AI. AI is still at a nascent stage. With the current population in developing nations globally still living below poverty line, adopting AI will be a fatal mistake for these nations. Plus the technological advancement with AI could make developed nations even more powerful and wealthy. AI needs a population which has high end technical skills so that they remain employed and do meaningful work. Right now, developing nations need to first adopt and go through industrial revolutions of previous ages to build an environment which can include AI. With free trade and such big technological differences it will become a daunting task to uplift people living in poverty. A global framework to regulate and monitor development and implementation of AI could help nations build better economies in respect to current technologies. The best way right now to uplift millions of people from poverty is labour intensive methods of production. It could be wrong, AI maybe able to help solve problems like education and health but till the time we don’t discover such solutions it remains in our best interests to protect the people by making it mandatory for countries to use labour intensive method of production and regulating free trade in case other developed nations start using AI at a large scale.

Conclusion

Capitalism has been the best mode to grow an economy. It will continue to remain so. Wealth inequality is the symptom of capitalism done wrong. It doesn’t mean that capitalism is the wrong way. It needs tweaks so that the pie becomes more equitable and just. Innovation, reward and risk still remain the best motivators for people to startup their own ventures. Capitalism needs to be reworked, whether one likes it or not but capitalism still remains the best way to move people out of poverty.

Leave a comment